Risk Assessment & Investment Policy Tool

Know your relationship with money and its impact on your future

This tool lies at the heart of our phygital offering-

Steps to Subscribe to Serenekit:

- Click the below link which will take you to the landing page of the “Risk Assessment & Investment Policy Tool”

- Create an account.

- Select either the free version or premium version

- Free version has 2 options – basic or advanced. Select one and proceed.

- Premium version has 3 options – click on “Become a Client” tab on the navigation bar to access and follow the below steps:

- Select one of the three fee plans.

- Complete the digital KYC.

- Make the payment.

- Digitally execute the advisory agreement.

What Is Risk? & Why Assess It Before Investing?

Risk Defined: In personal finance, risk revolves around the likelihood of not achieving your financial aspirations. A higher risk means a greater chance of shortfall, whereas a lower risk implies a closer alignment with your goals.

Risk in the Context of Investment Returns: Responsible Investing seeks not just to outpace inflation, thereby safeguarding your purchasing power, but also to yield additional income for your expenditures. The crux of an investment is its ability to fulfill these objectives and minimize the probability of not meeting your life goals.

The Investment Lifecycle: Your stage in life dictates the nature of your financial commitments. Investment returns that don’t align with your expectations or don’t materialize at the needed time can derail your plans.

Investment Risks: Ironically, while investments aim at higher returns to secure goals, they inherently possess risks. The primary avenues—shares and bonds—differ vastly. Shares offer potentially higher yet more volatile returns, while bonds tend to be more stable but with lesser returns.

Serenity's Risk Assessment & Investment Policy Tool

Guiding Critical Financial Decisions

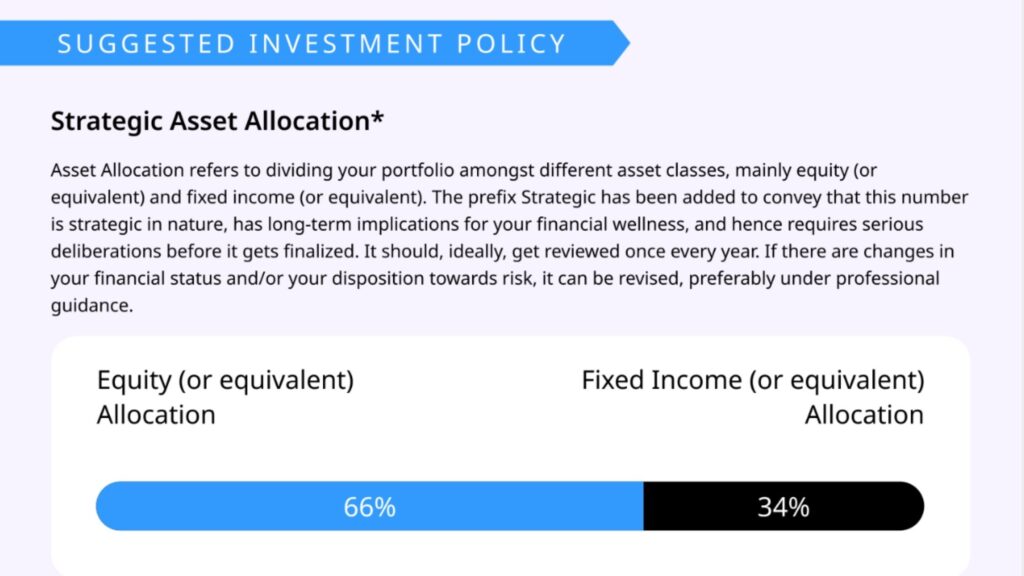

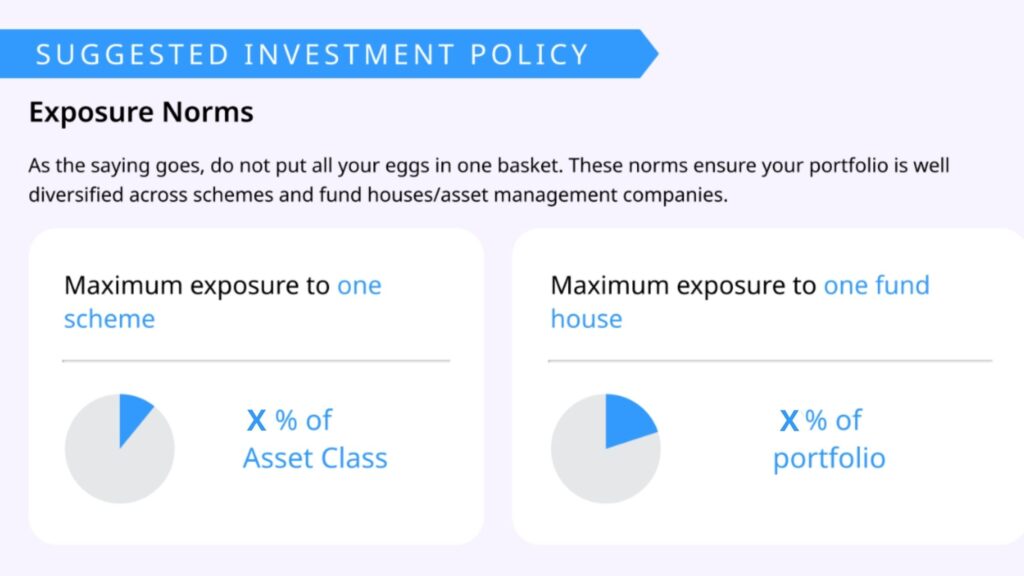

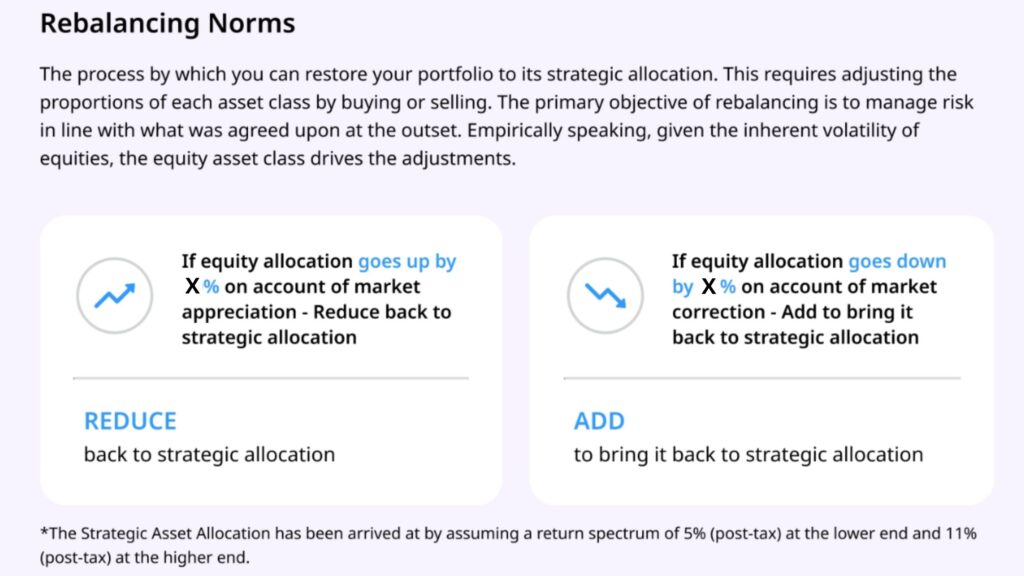

Purpose of the Tool:– This tool is crafted to help you pinpoint the returns you require and the timeline for their realization. It aids in determining the suitable mix of shares and bonds in your portfolio, considering the volatility of returns.

Yes, returns you require, not want. As investing is a means to achieve your needs & wants. It is not a want in itself. Unless of-course you are someone who has saved enough to the extent that even if you were to leave your savings in the bank, it won’t hurt your lifestyle. For the vast majority, it is about the return they require OR what is known as “Required Rate of Return” – a concept hitherto buried in academic books.

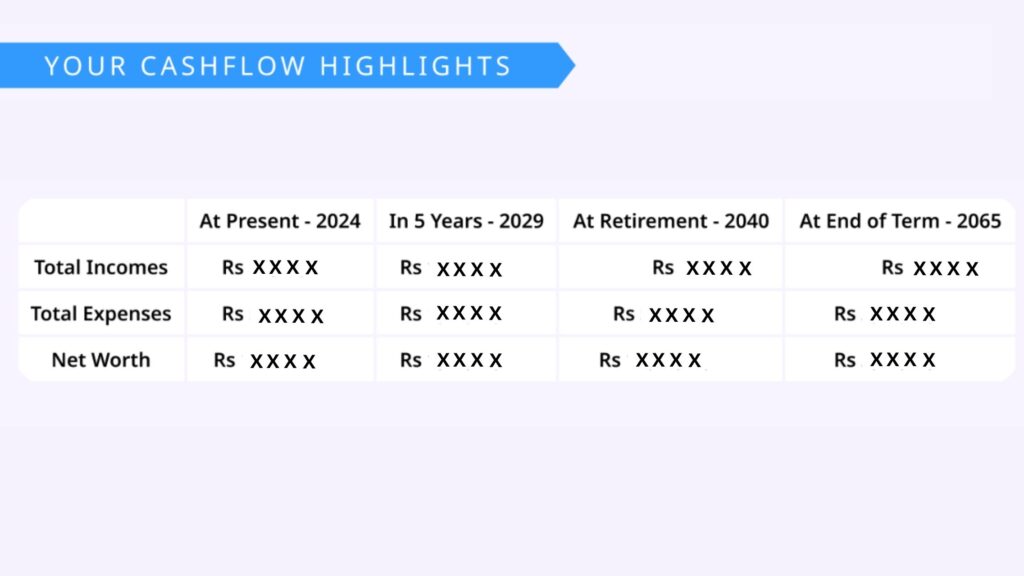

Required Rate of Return (RRR) is all about you & your personal finances. Your primary source of income, your current expenses, your net savings, your financial goals, your retirement plans, your insurance needs. It has nothing to do with the markets and investment options. The only economic variable is the rate of inflation.

The Risk Assessment Process:

However, estimating your RRR alone is not enough. You need to also map different types of Risk Factors. To estimate your RRR and to map the risk factors, the online tool provides for two questionnaires.

- A 20-question survey assessing your finances, goals, and savings.

- A 30-question risk tolerance and market awareness quiz.

Snapshots of Our Risk Assessment & Investment Policy Report

Your Data, Secured

We uphold the highest standards in data security, employing advanced measures to protect your personal information at every step of your financial journey with Serenity.