Trigger alert – reading time of the article is 10 minutes (Approx). However, if you get the gist of this article, it is half the battle won. And you might just wonder why would you even need a wealth manager.

Happy reading

Please do not get overly swayed by the technical language mentioned in the below para. I have attempted to explain the concept in much simpler language in the remainder of my article. This text is part of the theoretical framework behind what I refer to as 93>7 style of investing. I have simply copy-pasted the text from this article, which I found in the archives of the CFA Institute

https://blogs.cfainstitute.org/investor/2012/02/16/setting-the-record- straight-on-asset-allocation/

“Asset allocation relies on the notion that different asset classes offer returns that are not perfectly correlated and diversifying portfolios across asset classes will help to optimize risk-adjusted returns. The topic went largely unexplored until 1986, when Gary P. Brinson, CFA, Randolph Hood, and Gilbert L. Beebower (known collectively as BHB) sought to explain the effects of asset allocation policy on pension plan returns. In their seminal paper, “

Determinants of Portfolio Performance,” published in the Financial Analysts Journal, BHB asserted that asset allocation is the primary determinant of a portfolio’s return variability, with security selection and market timing (together, active management) playing minor roles. BHB’s 1986 study examined the quarterly returns of 91 large U.S. pension funds over the 1974 to 1983 period, comparing the returns to those of a hypothetical fund holding the same average asset allocation in indexed investments. A linear time-series regression yielded an average R-squared of 93.6%, leading BHB to conclude that asset allocation explained 93.6% of the variation in a portfolio’s quarterly returns”

Before I dwell further, I would like to provide a simple explanation to some of the terms you will be reading:

1. Equity – buying shares of a company, such that if the company does well, you gain and if it does not do well, you stand to lose. Our fathers and forefathers bought shares and many of us might have our individual stories on how well they did. Two important points, one – they held these shares for almost ever; two – they had no other way to participate in these companies, except to purchase their shares directly. Now, unless you have the interest and the time to do your own independent research, you are better off buying equity funds.

2. Equity funds – you are outsourcing the above exercise to a professional fund manager, who in turn has been employed by an Asset Management Company (AMC). They charge a fee (typically between 0.5 to 1%) on the value of your investments. IMP: these have also given very good returns*, provided they are held for long and unless circumstances demand, one stays invested forever. There are many variants of equity funds (schemes). There are other vehicles also (like AIF & PMS) but those are not relevant from this article’s point of view.

3. Bonds – this is like giving a loan to a company at a fixed rate of interest. So unlike in equity/equity fund where your return can be very high or very low (even negative), the return from bonds is, usually, fixed. Unless the company gets into bad times and is unable to pay the interest, or worse still, return your investments. There have been a few such instances in recent memory as well.

4. Bond funds – here too, you are outsourcing and instead of buying bonds directly, you buy through a bond fund. The management fee charged by the AMC is lower for bond funds as compared to equity funds. However, it can vary from as low as 15 bps to as high as 80 bps, depending on the type (schemes) of the fund.

5. Alternates – only for the sake of this article, let us assume that outside of equity funds, bond funds (and Gold & property), every other asset class is clubbed under “alternates”. Why do we call it alternates? That itself is a subject in itself and I will write on it in another article.

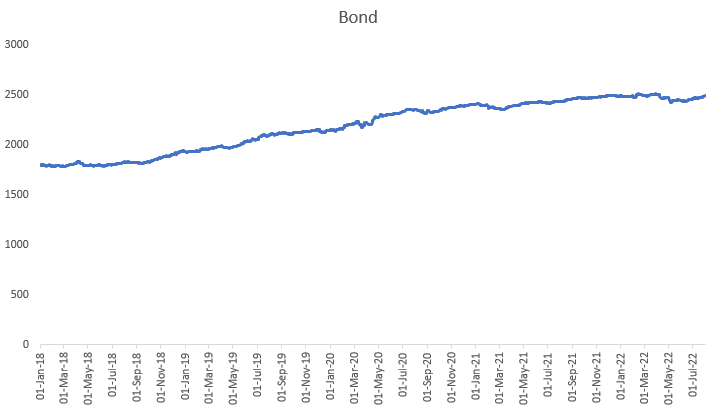

6. Asset Classes – equity, bonds, gold, property, alternates – all these are asset classes. Basically, different way you can invest your money in. Importantly, each has a very different return expectation. Likewise, both the linearity & predictability of the returns* also varies. Typically, the asset class which has a higher expected return has a more non-linear & less predictable path to achieving those returns. For example – in case of bonds, expected returns* are low to modest, and returns are linear and predictable, whereas in case of equities, expected returns are high, but returns are non-linear and unpredictable.

7. Asset Allocation – the proportions you invest in these asset classes. I know of investors who have invested more than 90% in equities and who have invested insignificant sums in equities. How to decide?

Use our Risk Tool. In a nutshell, it is only about you. How much return you need (or desire)? How comfortable are you dealing with non-linearity of returns?

8. Portfolio – your investments comprising of the above asset classes and the underlying products & schemes is your portfolio.

9. Product – there are several hundred professional fund managers vying for your attention, to whom you can outsource the process of buying & managing an asset class. The wrapper / platform through which they accept your money and manage, is the product. Though there are subtle differences, however, products and schemes are often used interchangeably.

10. Market timing – this is arguably the most discussed aspect of investments. Usually, the first question you might ask a friend who is connected to the markets “kya lagta kai?”. “what is your view?, will the markets go up and down? Is this the right time to buy or sell?”. While it is well known that no one can time the markets, most of us end up making decisions based on market timing. One of the biggest and unsolved conundrums of investing.

11. * Risk – it is commonly said that there higher the return, higher the risk. It is important to understand what risk implies here. We save money for future expenditure, and we invest our savings as money left in bank does not earn enough (after paying taxes) to beat even inflation. What we definitely do not want is that on the day we need to make the future expense, we are short as our investment has given us lower returns than what we had assumed while investing. Worse, our investment has gone down in value. This would imply, that we have to either postpone that expense or borrow money to bridge the gap.

12. Linearity of returns – A cursory look at the below two charts – one is that of an equity fund and the other is of a Debt fund – will explain the concept of linearity of returns.

Now going back to the 1st para, what it says in a nutshell is this:

“Asset Allocation Decisions Determine 93% Of Return Variability Between Portfolios, Whereas Scheme Selection Determines 6% And Market Timing 1%”.

In other words, what matters is not which equity-fund you hold, but what proportion of your portfolio is in equity funds/equities. For example, if your friend has 70% allocation to equities, and you have say 30% allocation to equities, if in a year equity markets do well, your friend’s portfolio will naturally do better than yours. However, the years equity markets do not do well, your portfolio will do better. Which specific equity-fund (scheme) you and your friend own will make very marginal difference.

Why? As over time, most of the schemes tend to mirror the broader equity markets. Yes, some exceptional one’s do much better, but it is not easy to identify those and also, you will always be guided to diversify across several schemes. You might ask what if you were to exit the equity markets when it is not expected to do well and then re-enter when it is expected to do well. There is very little evidence to suggest that this can be done successfully and consistently. Yes, there are a few (just a handful) highly sophisticated investors / fund managers, who run what is known as hedge funds. There also, the track record is a mixed bag, with many of them having had massive blow-ups. And therefore, by & large, it is suggested that attempts to time the markets be avoided.

However, in reality, there is disproportionate focus on schemes and market timing. Unfortunately, the industry also has played a role in perpetuating this focus, rather than addressing it, in no uncertain terms. Partly it is the tendency of playing along with what customers expect, partly it is also revenue considerations. There is a belief in a certain section of the industry that the importance of the wealth manager will diminish if the focus were to shift from products/schemes & market timing to asset allocation – nothing could be further from the truth.

A wealth manager must always endeavour to do what is right for the customer and do that with sincerity & integrity. If that needs to tell the customer to course-correct, so be it. The topic of this article reads as 93>7 style of investing. The number 93 is indeed greater than 7 – there is no evidence required to prove that. However, the disproportionate & undue focus on products & market timing (7%) at the cost of asset allocation (93%), implies that in the investing world, 7 is considered greater than 93.

Let us re-set our priorities and adopt the 93>7 style of investing.