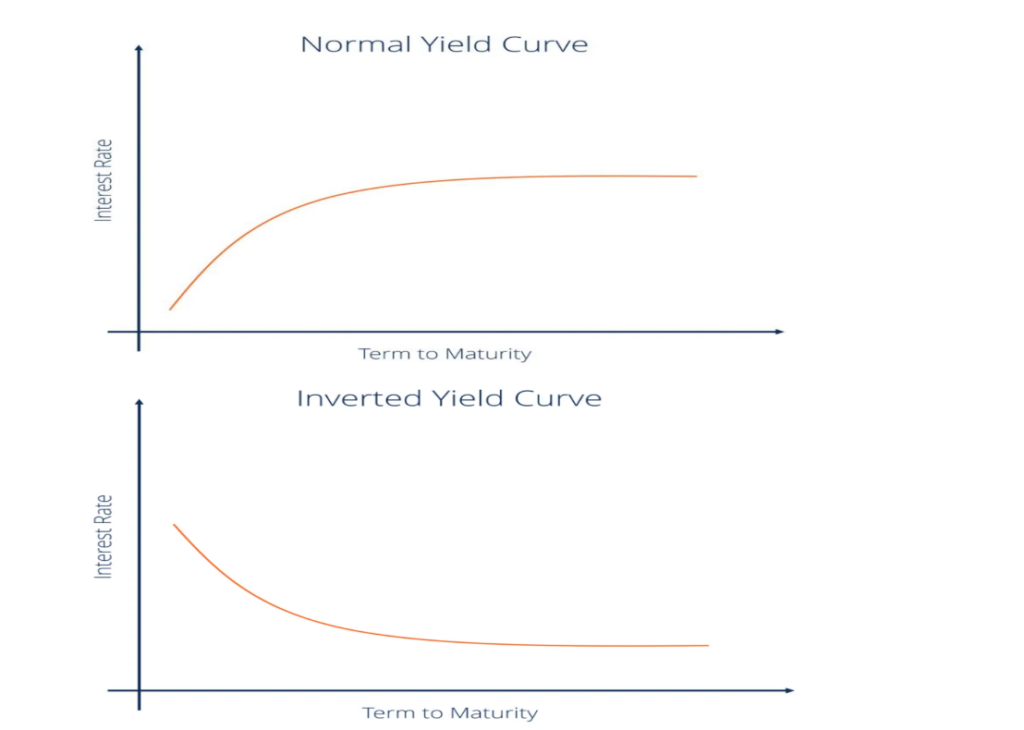

The Yield curve is simply a X-Y axis chart which plots time on X axis and interest rate on the Y axis. You would agree that if you were to invest in a Fixed Deposit of 1 year, you will get lower rate of interest as compared to a 5-year Fixed Deposit. Likewise, is the case with bonds issued by governments and corporates. Similarly with debt-oriented mutual funds, which are nothing but an aggregation of all such bonds.

Naturally, if a bank or a company or the government wants to borrow for longer periods, you will demand a higher return. Hence, the yield curve is usually upward sloping. However, it is not a straight line. As you increase the time-period the curve gets flatter, as you can see in the first picture.

Now when the outlook for the future is not all that good or worse, bleak, the yield curve inverts – please see the 2nd graph below . This happens when interest rates on short-term bonds exceed those of longer-term bonds. Typical reason attributed to this is that lenders (or investors) do not want to lend for long term as they are unsure about the medium to long term future. There are other technical reasons as well such as money supply.

Incidentally, in each of the previous eight U.S. downturns, the yield curve has inverted

before the economy sputtered. And if you were to do a google search on “inverted yield curve”,

you will see a lot of literature and articles on it being one of the leading indicators of a looming recession. Check this link from Investopedia for those who wish to understand this concept in greater detail.

However, this time around the yield curve has been inverted for a record stretch—around

400 trading sessions —with no signs of a major slowdown. If a recession doesn’t materialize

soon, it could do lasting damage to the yield curve’s status as a warning system.

The excessive printing of currency by governments (specially USA) post the global recession

accentuated by Covid relief; increasing de-globalisation with USA & China being at loggerheads

(things only seem to be getting worse); USA’s disproportionate sanctions on Russia post

invasion of Ukraine leading to several countries moving their foreign currency assets from US dollar to gold (de-dollarisation) – all of this, coupled with the yield curve getting inverted was pointing to a recession. And almost every research house had called out a recession.

What seems to have happened is that all these factors have also led to a new world order where the rules of the earlier world order no longer apply. US economy has been naggingly resilient

and has foxed everyone, including the Federal Reserve. One reason could be that most of the loans (specially the personal loans) were fixed rate loans. By some measure, around 70%.

Hence, the EMIs have not been re-set. The re-sets will start to happen soon. At which point, the EMIs should sharply get revised.

So, while this leading indicator of a recession is seemingly now in a recession of its own, it might still hold true, in the near to medium-term future. Time will tell…

Implications for India – Equity markets are intricately linked. Hence any global event will affect us. However, India due to its demographic dividend story (albeit, in our view this has been

overplayed, and unless our GDP does not grow at much higher rates from where we are and we do not invest on human capital), we might not reap the real advantage of it) is in a sweet spot.

And should continue to attract foreign investors. Even more so if their own home country is in some sort of distress.