A key question facing many families is how to go about selecting wealth managers and put together an efficient & virtuous wealth management structure.

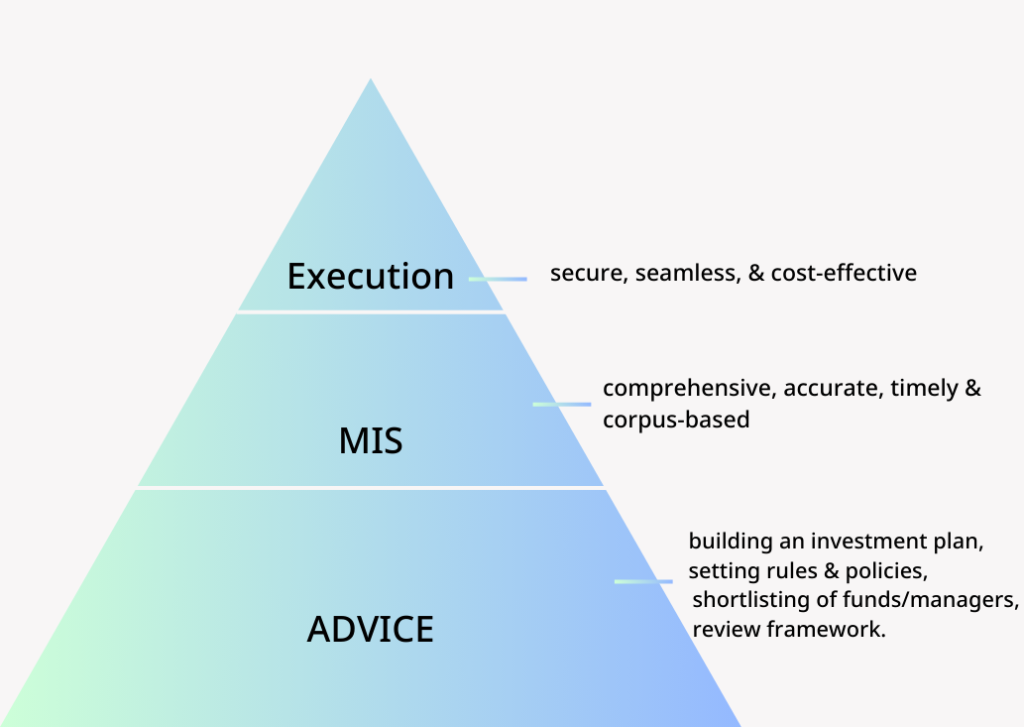

If we were to break it down, there are broadly three independent layers of decision-making:

- Advice

- MIS

- Execution

These can be best explained by the pyramid structure, with the bottom of the pyramid representing Advice, the middle layer representing MIS, and the triangle at the top representing Execution. While each of the three layers is important, the bottom of the pyramid is, arguably, the most important and needs the maximum share of the family’s time & resources.

Let us look at each layer separately and understand the considerations that should go into the decision-making process:

ADVICE:

The most important consideration should be whether the advice is free of any conflicts of interest & if there are any, are they getting highlighted upfront.

There are three potential conflict areas, which can lead to advice getting tainted.

1. How is the wealth management firm earning from you? Which is the dominant model?

When the firm earns from you by way of commissions, there is bound to be conflict as there is always a possibility of the firm pushing asset classes / products where they earn higher commission.

The regulator (SEBI) has very clearly said that only wealth managers who earn by way of fee from their clients, can render advice. Those who earn by way of commissions, cannot give overall / holistic advice.

An important point here is that while you might have worked out a fee-based arrangement, it is important to know what % of the firms’ revenue is coming from fee, and what % from commission? Most large format firms continue to have a dominant share of their revenue from commissions. This, as per us, is a red-flag, given that it is over 10 years SEBI allowed wealth firms to move to the fee-based model.

2. Does the wealth management firm have its own products?

The key role of a wealth manager is to build an investment plan and then go on to allocate the funds across various fund managers & products. In doing so, the only consideration must be merit and fitment. When a wealth management firm has its own products & funds, there is bound to be conflict of interest.

I have indeed, come across relationship managers who are able to withstand internal sales pressures, but it is not easy and when they see others getting rewarded, it can affect their judgment.

Importantly, why should a wealth management firm even get into managing in-house funds and launching proprietary products. Fund management is a separate business altogether. We believe they do so for 2 reasons: one, it’s an industry norm, others are doing & they feel obliged to; two, revenue considerations, as margins on own products are higher.

PS – when the wealth management firm is part of a large Institution, it is likely that another vertical of the Institution is into fund management. So long as the two operate on an arms-length basis, it is fine. My point is when wealth management firm is launching products and managing funds in-house.

3. Is the firm genuinely playing the role of a “Gatekeeper”?

The wealth firm must have the intent and the capability to evaluate products & managers across the eco-system. Everyone should be welcome, including their staunchest competitor. As they are representing the interest of their client, and the client should get to see all that is available.

An important point to be noted is that many fund managers do not have the business-development machinery (or the knack or the inclination) to manage distributors and work out commercials. For one or the other reason, they are unable to navigate the conversations around sharing of commercials – many (if not most) large format firms insist on a commercial arrangement, as they want a share of the income. Why should that become an impediment specially if the wealth firm has clients who have appointed them as advisors?

We have come across fund houses who are doing interesting strategies, but surprisingly, don’t get recommended by wealth managers. It is one thing if they have a fundamental issue with the fund house or it’s philosophy, it is quite another if the reason is that the fund house is not willing to get into a distribution arrangement.

Most, if not all, Institutional wealth management firms fall short on all the above. This could be true, even in the global context. Their revenue split has multiple sources, advisory fee being just one of them. Commissions from distribution of mutual funds, spread income on secondary debt (difference between buying & selling), fund management fee from in-house funds, brokerage income from direct equity, referral fee from distribution of PMS and AIFs. While this might be great from the firms’ point of view, and one can argue that why should anyone have any issue with that, the key question is whether this is right for you and your wealth management process?

On the other hand, small format firms (boutiques) tick all the above boxes. They are (most are) 100% focused on fee-based advisory business and have no other distractions.

From our viewpoint, when it comes to the advice layer, “small is indeed beautiful”. Of-course, small is relative as many of these boutique firms (especially in the global context) manage sizeable assets, running into billions of dollars.

What if the boutique were to go down the same path, to become large? That is a potential risk. Incidentally, there have been instances in India as well. You need to watch out for that.

What about market views? Won’t Institutions score over boutiques? Institutions have far more resources & can churn out realms of research reports. However, how is that helpful to you, is an important consideration. Also, the track record of these market views needs to be examined.

Do also have a look at these two linked-in posts I wrote on (1) whether there is a case for product teams in wealth firms & (2) on the recent trend of wealth firms offering low grade NCDs:

MIS:

“You can’t manage what you can’t measure” – this also applies to our wealth.

As the word implies, MIS (Management Information System) is a system that provides regular and relevant information to the management, which in this case is the owners of the wealth and people around them, including the advisors.

The key attributes of a good MIS are:

-

- No dependence on any external agency.

- Their investment decisions are well-planned.

What helps is that Mutual Funds have presence all over and their teams are very happy to enable the transactions.

- POA models: the large-format Institutions offer a facility whereby they get limited power of attorney to debit your bank account and credit the fund’s account based on email & voice consent. This is a very common offering by Institutions, globally. In terms of costs:

- Investor must invest in regular plans – so there is a yearly commission. OR

- Investor must hire the Institution as an advisor and pay an advisory fee.

In addition to MF/AIF/PMS, the 4th avenue of investment is listed stocks, bonds, and other products like listed REIT & InVit’s, for which one needs a broking account with a broker. Some of the brokers also enable the purchase of mutual funds under the Direct fee plan.

Efficient execution also has implications on the MIS process. To put together an MIS, you need transaction data across all your investments. Hence, putting together a super-efficient execution apparatus is critical.

From our viewpoint, the POA model offered by large & credible Institutions (you do not want to give a POA to a small or even mid-sized firm) is clearly the preferred route. It is convenient, paperless, and ensures transaction data is getting captured properly, in one place.

Conclusion:

Usually, Institutional wealth managers offer their end-to-end service as a virtue. But as we have highlighted, the end-to-end services come with strings attached. We recommend a horses-for-courses approach. The phrase horse-for-courses alludes to the fact that a racehorse performs best on a racecourse to which it is specifically suited. Likewise, used idiomatically in English to refer to the wisdom of choosing the right tool or worker for the job at hand.

What we mean is that the answer to the original question of selecting a wealth manager does not lie in one firm. Each of the three layers needs a separate solution.

- Advice – it, being the most important layer, needs an independent fee-based advisory firm, which is 100% focused on fee-based advisory and can play the role of a gatekeeper. In this note we have covered the investment layer. Advice goes beyond investments into several areas, most important being planning for succession, smooth transition, geographical diversification, tax & accounting frameworks. To do justice to all these, the wealth firm needs to play the role of a genuine gatekeeper & get you the most optimum solution & service. The same firm can be tasked to solve for the other two layers as well. At Serenity, we get involved in setting right the MIS & execution frameworks, irrespective. A good MIS and efficient execution not only help the family, but it also makes our advisory process efficient.

- MIS – you might wish to explore some of the systems that are available outside of the wealth management industry. At Serenity, we have helped our clients identify the right MIS partner.

- Execution – globally, many of the large Institutions have aligned themselves to the reality that their clients might wish to only avail execution services from them and therefore, offer an execution-fee only model as well. This trend is slowly catching up in India as well.

At Serenity, we consider it as our responsibility to help our clients find the right execution partner.

- Online platforms: Interestingly, even very large investors exercise this option, especially if they are online savvy. Certain online platforms (like MFU) allow a 3rd party to upload the transaction, post which the investor authorises.

- Paper mode: while in this day & age, it is expected that execution be paperless, there are large families which prefer the paper mode for 2 reasons:

-

- No dependence on any external agency.

- Their investment decisions are well-planned.

What helps is that Mutual Funds have presence all over and their teams are very happy to enable the transactions.

- POA models: the large-format Institutions offer a facility whereby they get limited power of attorney to debit your bank account and credit the fund’s account based on email & voice consent. This is a very common offering by Institutions, globally. In terms of costs:

- Investor must invest in regular plans – so there is a yearly commission. OR

- Investor must hire the Institution as an advisor and pay an advisory fee.

In addition to MF/AIF/PMS, the 4th avenue of investment is listed stocks, bonds, and other products like listed REIT & InVit’s, for which one needs a broking account with a broker. Some of the brokers also enable the purchase of mutual funds under the Direct fee plan.

Efficient execution also has implications on the MIS process. To put together an MIS, you need transaction data across all your investments. Hence, putting together a super-efficient execution apparatus is critical.

From our viewpoint, the POA model offered by large & credible Institutions (you do not want to give a POA to a small or even mid-sized firm) is clearly the preferred route. It is convenient, paperless, and ensures transaction data is getting captured properly, in one place.

Conclusion:

Usually, Institutional wealth managers offer their end-to-end service as a virtue. But as we have highlighted, the end-to-end services come with strings attached. We recommend a horses-for-courses approach. The phrase horse-for-courses alludes to the fact that a racehorse performs best on a racecourse to which it is specifically suited. Likewise, used idiomatically in English to refer to the wisdom of choosing the right tool or worker for the job at hand.

What we mean is that the answer to the original question of selecting a wealth manager does not lie in one firm. Each of the three layers needs a separate solution.

- Advice – it, being the most important layer, needs an independent fee-based advisory firm, which is 100% focused on fee-based advisory and can play the role of a gatekeeper. In this note we have covered the investment layer. Advice goes beyond investments into several areas, most important being planning for succession, smooth transition, geographical diversification, tax & accounting frameworks. To do justice to all these, the wealth firm needs to play the role of a genuine gatekeeper & get you the most optimum solution & service. The same firm can be tasked to solve for the other two layers as well. At Serenity, we get involved in setting right the MIS & execution frameworks, irrespective. A good MIS and efficient execution not only help the family, but it also makes our advisory process efficient.

- MIS – you might wish to explore some of the systems that are available outside of the wealth management industry. At Serenity, we have helped our clients identify the right MIS partner.

- Execution – globally, many of the large Institutions have aligned themselves to the reality that their clients might wish to only avail execution services from them and therefore, offer an execution-fee only model as well. This trend is slowly catching up in India as well.

At Serenity, we consider it as our responsibility to help our clients find the right execution partner.