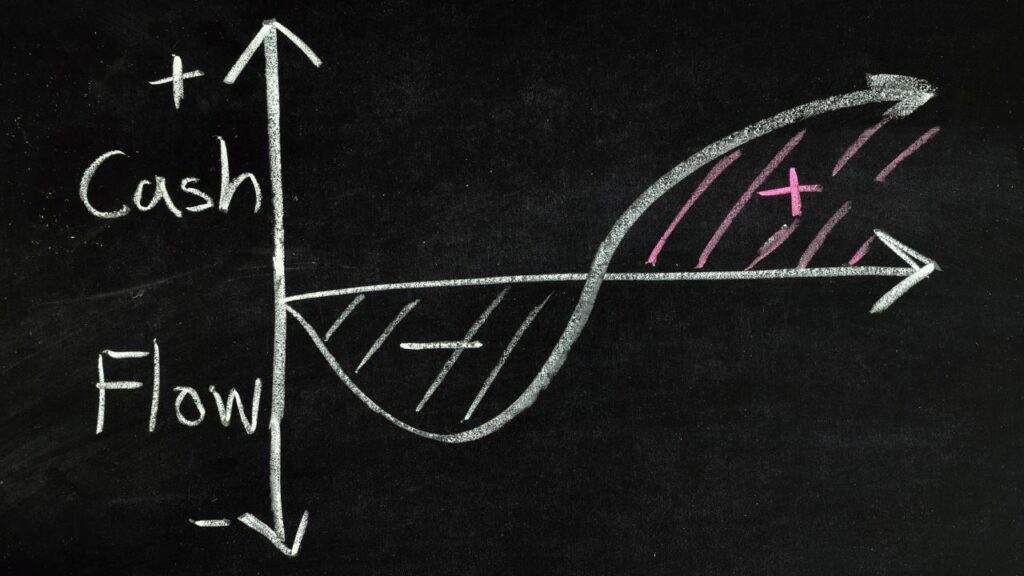

Cash flow planning is like making sure you have enough gas in your car to get to your destinations throughout the month. It’s about creating a roadmap for your money to ensure that not only do the bills get paid but your financial goals are being systematically met.

Assessing Income Streams

Take into account your total income, including salaries, returns from investments, and any passive income channels. This enables a comprehensive view of financial capabilities.

Expenditure Management

Categorizing expenses gives you a clear picture of where your income is going and helps in identifying areas where you can redirect funds for savings. Allocating resources to investment rather than non-essentials can compound your future benefits.

Emergency Fund Allocation

Setting aside funds for unforeseen circumstances. Save several months’ worth of living expenses in case of unexpected events like job loss or medical emergencies. An emergency fund is vital for weathering financial uncertainties without derailing your financial plan.

Reduce Debt

Carefully plan for debt repayment, focusing on high-interest debts to free up more resources in the future for wealth generation and investment opportunities.

Plan Large Purchases

If you need to make a big buy, like a car or appliance, save for it in advance to avoid disrupting your monthly cash flow.

Continuous Financial Review

Adaptability is key in cash flow planning. Regularly reviewing and adjusting your financial plan for any life changes ensures that you remain on track toward your wealth management objectives.

Effective cash flow planning is not merely about budgeting; it is about planning your revenues and expenditures in such a way that supports the lifestyle you desire while working towards the financial legacy you wish to build.