1. Directionally the changes are welcome. We have had, for far too long, a capital gains tax regime which was, one, complex and two, contributory to a lopsidedness of the risk-return paradigm of various asset classes. What I mean by the latter is that asset classes should compete equally for your allocation, only on risk & return and not due to tax advantages.

However, to promote different asset classes (for ex. to set in place an equity culture) and to give tax benefits to various sections of society, governments do give favourable tax treatment to certain instruments. That in turn affects the interest of other stakeholders. For example. the banking sector was suffering due to the tax advantage given to debt funds.

The evolution of our capital gains taxation regime is a testimony to that. For example – bonds issued by Public Sector companies enjoyed a tax-free status at one point; OR Real Estate Investment Trusts (REITs) enjoy certain tax benefits on the income (rentals) they earn from the underlying properties.

Equity, as an asset class, has historically had the most favoured capital gains tax regime, which became even more disproportionate post the changes brought in on taxation of debt funds in March’23. This change was done so that the Banking sector could compete on an equal footing (for their Fixed Deposits) with debt funds. However, in the process even gold funds & feeder funds were affected as they got included in the category of specified funds which henceforth were to get taxed at slab rate.

This budget has tried addressing the above to a very great extent and has effectively bought most asset classes on an even keel, the only difference being the holding period for an asset (being sold) to qualify as long term or short term. And we feel that is a step in the right direction.

2. The one big exception which remains is debt-oriented mutual funds (funds which own debt securities > 65%) which continue to be taxed at slab rate. Until March’23 the effective taxation on these funds was almost like equity funds, if held for more than 36 months. The only difference being the holding period. Equity funds qualified as long term if held for 12 months. Hence, there was no difference when the asset classes were compared on a pre-tax and post-tax basis. Tax was not a consideration. Banks were suffering as Fixed Deposits would complete with debt funds on a pre-tax basis but on a post-tax basis, they were taxed at slab rates even if held for 36 months.

Because of this change done in March’23, on a post-tax basis, debt funds became an even more unattractive investment option. This has led to investors allocating to either equity’s or higher-yielding debt securities – in both cases taking more risk, than what they need or can tolerate.

We looked up how say a country like USA taxes its citizens on debt & equity funds. The principle they follow is like ours – equity funds enjoy lower capital gains tax @ 20%, if held for more than a year, whereas debt funds are taxed at slab rate. However, equity funds are taxed at slab rate if sold within a year.

Now why should that be the case? The fundamental reason being that debt funds derive bulk of their growth on account of interest they earn from underlying debt instruments. Technically, that is not a capital gain. Whereas equity, property, gold, silver etc derive bulk or all of their growth on account of appreciation in value (or gain in capital).

Indian investment industry found a solution by directing investments into hybrid funds (which have a mix of debt & equity). There are hybrid funds which have minimum 35% debt instrument to as high as 65% debt instruments and get a favourable tax treatment. However, for investors who do not want any equity exposure and want to simply invest in high quality bonds or high-quality bond (or debt) funds, they get taxed at the slab rate.

Ironically, this taxation regime has not helped the banking sector as arbitrage funds (which have a risk profile somewhat like debt funds) get taxed as equity funds and have seen a huge surge in their assets. This prompted one of the most prominent bankers of the country to make a statement early this year that India cannot prosper in a one-legged race. He was alluding to the big difference in taxation of equity and debt funds / Fixed Deposits, coupled with the favourable tax regime arbitrage funds enjoy.

To this end, Government has narrowed the gap by increasing the LTCG on equity, albeit only marginally. Our sense is that the gap will get further narrowed in subsequent budgets, i.e. long-term capital gains on equity will further go up and the short-term capital gains on equity might start getting taxed at the slab rate. In any case, F&O trading is also taxed similarly.

3. For the old timers in the wealth management industry, indexation had been an integral part of tax calculations for sale of properties and debt-oriented funds. This concept is now history – so there is a feeling of nostalgia. The annual publication of inflation index will now be a thing of the past. More importantly, specifically for sale of properties, it implies that if you sell your property, there will be a tax implication.

In fact, in certain situations, it is possible that the new tax regime might be better as compared to the old regime. Later in the evening on the budget day, it was also clarified that for properties bought prior to 2001, indexation will be available. We are not clear if the taxpayer has a choice on which regime to choose.

We tried looking up the tax regime for countries like USA & UK. The limited desktop research we could do suggested that UK has experimented with inflation indexation. In the 70’s high-inflation era, government agreed to allow taxpayers to adjust their cost of purchase with inflation. However, in subsequent years, they have imposed restrictions on it.

Net-net, we have mixed feelings:

- We welcome the rationalisation,

- We hope to see a more level playing field between debt & equity, and

- We are a little nostalgic about the concept of indexation becoming history.

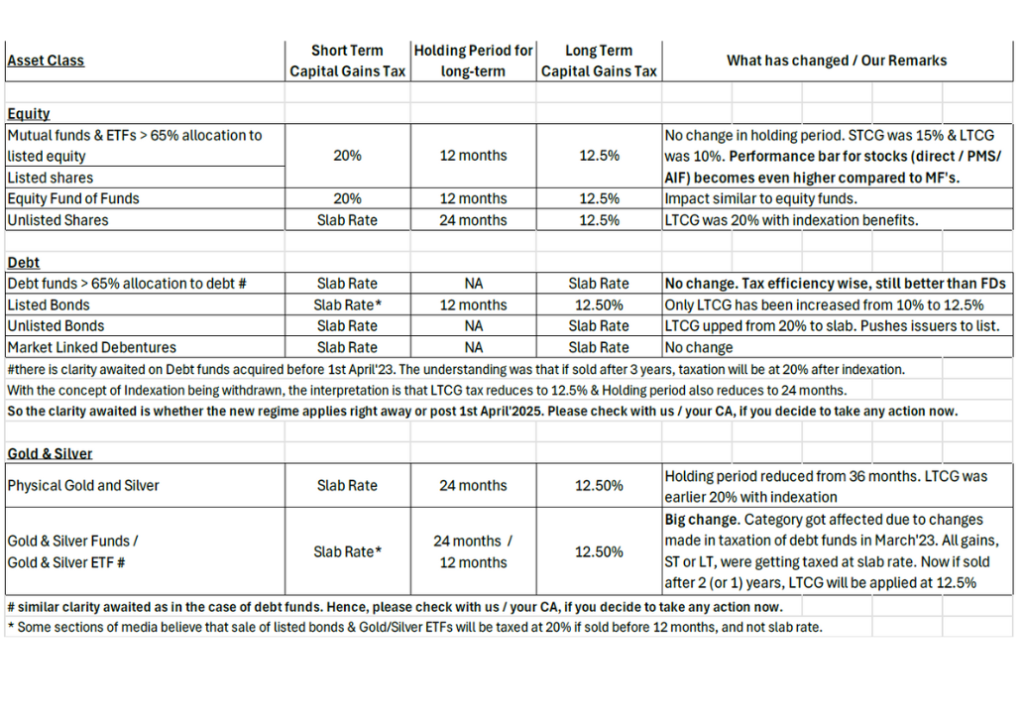

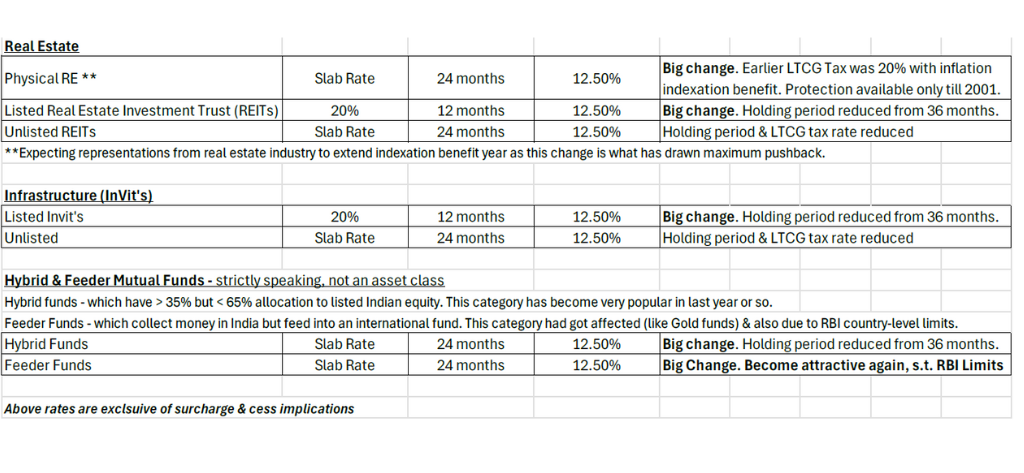

Please see the below table for the summary at an asset class level. We hope this makes for an easier reading, as compared to the other notes you would have received. A necessary disclaimer:

➢ As wealth managers, we must have a good understanding of investment related taxes. However, we are not a CA firm or tax experts. We put this note basis our understanding of the Budget & conversations we had with tax & industry experts. On certain points, clarity is awaited. Hence, before you make any investment decisions, please speak to us or to your CA.

A quick re-cap, based on:

(A) If instrument you hold is listed or unlisted:

- Anything listed (shares, bonds, equity / gold / silver ETF, reit, invit) and if held for more than 12 months will be taxed at 12.5%

- of the above, shares, reit, & invit enjoy a lower tax @ 20% if sold within a year; bonds, gold, silver get taxed at slab rate. Some sections of media believe they will also be taxed at 20%.

- Anything unlisted (shares, reit, invit) and if held for more than 24 months will get taxed at 12.5%. If sold within 24 months, tax will be at slab rate.

- The only exception is unlisted bonds & MLDs which will taxed at all points at slab rate.

(B) If you hold the mutual fund, check the type:

- If > 65% held in Indian listed stocks, then same status as stocks. Added benefit being that they do not pay taxes when they churn their portfolio. Only when you exit the fund, there is tax incidence.

- If > 65% held in debt (the poorest cousin), then taxed at slab rate.

- Only if bought prior to 1st April’23, they have been given a boost in this budget – holding period reduced to 24 months.

- Rest of the mutual funds (Hybrids which are neither holding > 65% equity nor > 65% debt; Feeder funds; Gold/Silver funds) now taxed at LTCG tax of 12.5% if sold after 24 months. If sold earlier, at slab rate.

(C) If you hold physical assets:

- Real Estate / Gold / Silver – Indexation benefit removed (w.e.f. 2001 for real estate) and LTCG tax reduced to 12.5%. Short term gains continue to be taxed at slab rate.