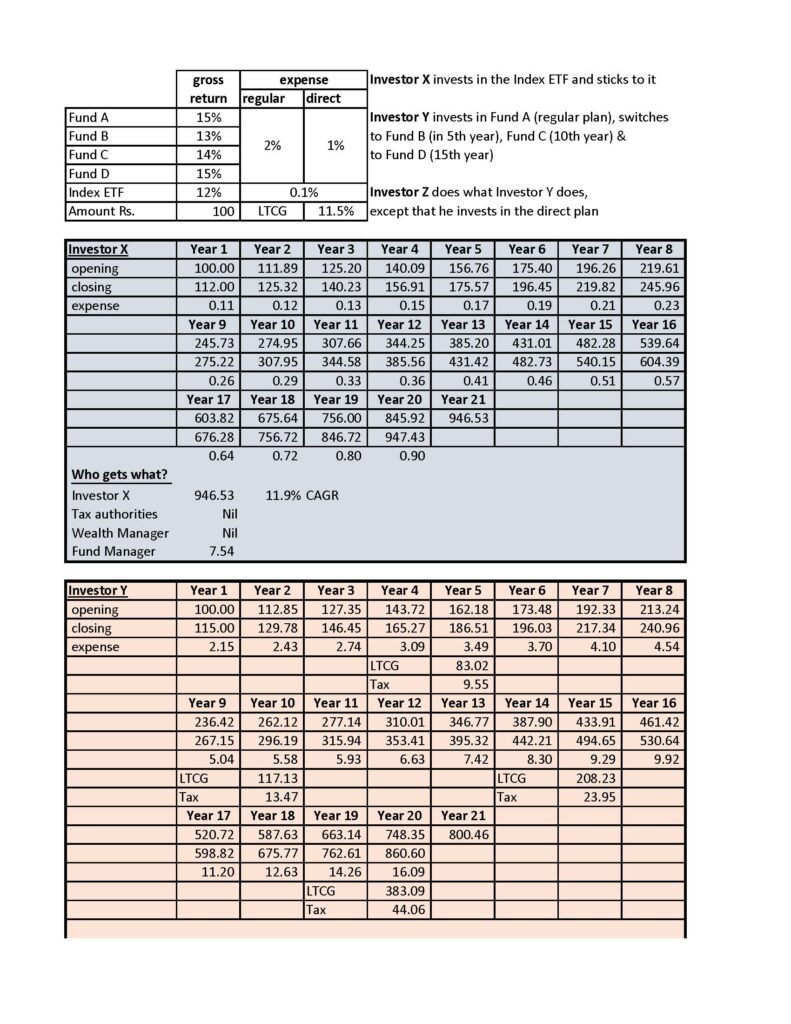

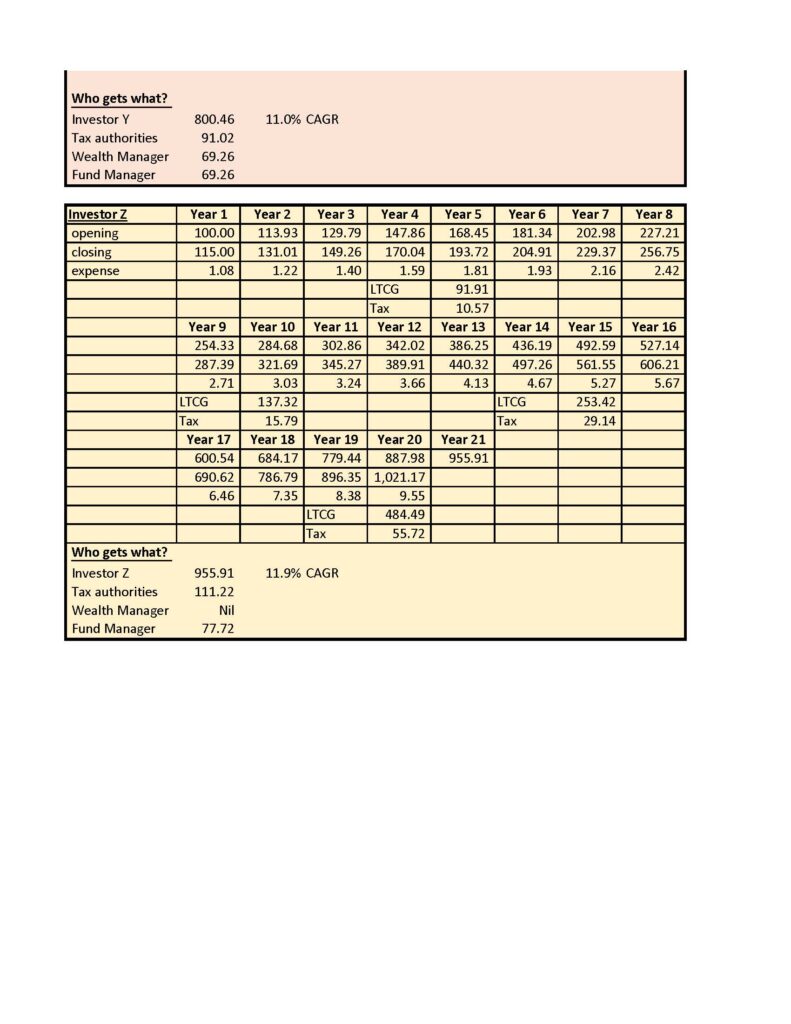

#Whogetswhat from #yourhardearnedwealth, how does the kitty get divided between – you, the distributor/wealth manager, the fund manager, the tax you pay?

Had put this sheet together to highlight the importance of:

(1) Investing under direct plans (sans distributor commissions) – as the distributor commissions gets knocked off from your investment year after year, thereby hurting the compounding of your wealth

(2) Sticking to the chosen few funds* and not looking to constantly churn – as the tax you end up paying every time you sell, hurts the compounding of your wealth

* fund-managers will go up and down in rankings. They will have their good, not-so-good and bad years. As long as they remain in top quartile and / or they are performing reasonably ok, stay invested. As when you churn, you pay tax. And what is the guarantee that the fund you buy performs better than the fund you redeem. The Wealth Manager doesn’t take any such guarantees, and neither should he.